Search results

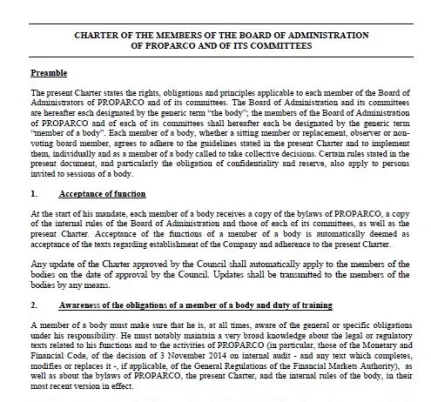

Charter of the members of the board of administration of Proparco and of its committes

Charter of the members of the board of administration of Proparco and of its committes - July 4, 2025

Publication

Published on

AFD - Panorama 2016

With pragmatism and determination, AFD teams are currently working on more than 2,500 development projects across the world - supplying water to parched land and people in Jordan and electricity to th...

Publication

Published on

AFD - OVERVIEW

Building a more just and more sustainable world for all – a world in common – requires successfully achieving five main transitions, both over here and over there: energy, digital, territorial, demogr...

Publication

Published on

Proparco Key Figures - 2016

THE PRIVATE SECTOR, AN ESSENTIAL DRIVER OF ECONOMIC GROWTH Proparco has sustained the momentum for the fifth year in a row, growing by 21% approving financing of close to €1.5 billion for businesses...

Publication

Published on

PROPARCO's activity Report 2016

2016 was a significant year for Proparco: implementation of the Sustainable Development Goals (SDGs), the Addis Ababa Action Agenda on financing for development, and the Paris Climate Agreement which...

Publication

Published on

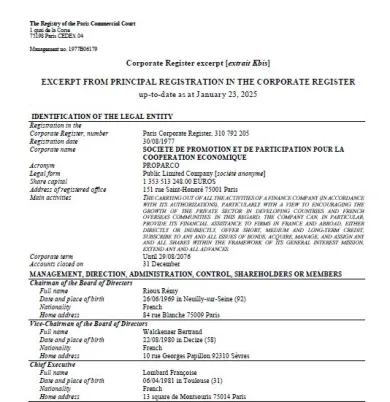

Proparco Corporate Register excerpt [extrait Kbis]

Proparco Corporate Register excerpt [extrait Kbis] - 23th of January, 2025

Publication

Published on

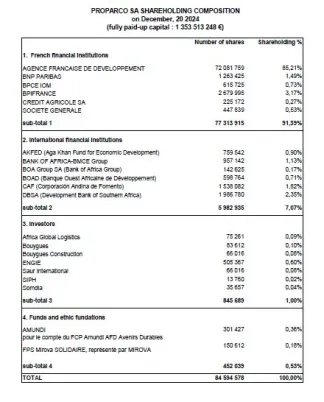

Proparco SA shareholding composition

Proparco SA Shareholding Composition - December 20, 2024

Publication

Published on

Special issue - Private sector and digital innovation: catalyts for development

This special issue of Private Sector & Development magazine, published to mark Proparco’s 40th anniversary, focuses on how digital technology can help to achieve the UN’s Sustainable Development Goals...

Publication

Published on

Forty years of actions supporting economic development

In this anniversary book, we highlight 40 projects that depict a portion of Proparco’s history. They were chosen because they have graced the pages of our annual reports, or have left a lasting mark o...

Publication

Published on

Rules of procedures of the Appointments committee

Rules of procedures of the Appointments committee.

Publication

Published on

The rules of procedures of the Investment advisory committee

The rules of procedures of the Investment advisory committee - July 4th, 2025

Publication

Published on

Rules of procedure of the Risk and audit committee

Rules of procecure of the Risk and audit committee

Publication

Published on

Strengthening the capabilities of clients' companies

Strengthening the capabilities of clients' companies

Publication

Published on

Strategy 2017-2020 : Grégory Clemente, CEO of Proparco

Objective 2020: double its annual commitments to EUR 2bn in order to increase the private sector’s contribution to development. The objective is to triple its impacts on sustainable development (emplo...

Publication

Published on

video - Vulnerabilities and crises: what role for companies? edition no. 27 of Proparco’s magazine

In its June – September 2017 issue entitled, “Vulnerabilities and crises: what role for companies?”, the Private Sector & Development review looks at the various different issues related to private se...

Publication

Published on

Video - The African Ports Sector: edition no. 26 of Proparco’s magazine

"African Ports : gateway to Development" : Issue no. 26 of Private Sector & Development focuses on the African port sector. The magazine features analyses provided by experts to get an insight into th...

Publication

Published on

3 questions to Lerionka Tiampati, CEO of Kenyan Tea Development Agency (KTDA)

Publication

Published on

3 questions to Matthew Boadu Adjei, Founder & CEO of Oasis Capital Ghana Limited

This fund invests in SMEs in Ghana and Côte d’Ivoire that help to improve access to essential goods for vulnerable sections of the population. AFD Group wishes to partner this initiative and it has ju...

Publication

Published on