Search results

Replay webinar: "Success Stories in the Creative Industries in Africa and Other Emerging Markets"

This webinar explored how innovative financing mechanisms, such as the CREA Fund—implemented by Proparco and supported by the European Union through the CreatiFI initiative—are empowering the growth o...

Publication

Published on

Taking over at the helm of a company: duties, challenges and solutions

The issue of taking over at the helm of a company has long been – and is still today – a taboo in Africa. When the time comes to appoint a successor, it is often perceived as being the end of the worl...

News

Published on

Private Sector & Development #16 - New players and new banking models for Africa

The African banking sector – largely dominated by the European banks through to the late 1990s – is currently undergoing radical change. Alongside the sector’s traditional players, regional operations...

Publication

Published on

Private Sector & Development #17 - Does the private sector help improve healthcare systems in developing count...

There is no denying the healthcare progress made by developing countries. However, the sector needs additional financing to meet growing needs. What is the role for private investment?

Publication

Published on

Special issue - Independent power producers: a solution for Africa?

Demand for electricity in sub-Saharan Africa is growing fast – driven primarily by economic growth and by policies for widening access to electricity – and yet production capacity has developed very l...

Publication

Published on

Private Sector & Development #20 - Unlocking the potential of the private sector to improve education

Significant progress has been achieved in the education sphere since the World Education Forum in Dakar in 2000. In ten years, the number of children attending primary school in the world’s developing...

Publication

Published on

Private Sector & Development #19 - Private sector crucial to resolve housing challenges

Decent, affordable housing is crucial to development. It determines living standards; its location affects employment opportunities, while its mass construction can generate thousands of jobs.

Publication

Published on

Private Sector & Development #21 - Promoting CSR in Africa: a sustainable development opportunity

The last decade has seen the CSR spread across every continent, transforming businesses. The major international organisations have produced guidelines, norms and standards to provide the private sect...

Publication

Published on

Private Sector & Development #22 - Scaling-up private sector climate finance

This twenty-second issue of Private Sector & Development investigates the private sector’s role in financing the energy transition, exploring pathways for achieving the expansion that is so crucial fo...

Publication

Published on

Private Sector & Development #23 - Social Business: a different way of doing business and investing

In recent years, the concept of social business has emerged as a middle road between philanthropy and the pursuit of maximum profit. This is the topic of the 23rd Private Sector & Development magazine...

Publication

Published on

Private Sector & Development #24 - Air transport, a vital challenge for Africa

Air transport in Africa still does not count for much on a global scale. However, strong GDP growth, the continent’s fast-growing urbanisation and the expansion of the middle classes – who want to tra...

Publication

Published on

Private Sector & Development #25 - The african insurance sector: building for the future

This edition of Private Sector & Development looks at the opportunities and obstacles facing insurance in Africa and presents analyses prepared by a number of sector stakeholders (insurers, researcher...

Publication

Published on

Private Sector & Development #26 - African ports: gateway to development

This 26th issue focuses on the African port sector. The magazine features analyses provided by experts from ISEMAR, SETRAG, Jeune Afrique and AFD, to get an insight into this rapidly growing sector th...

Publication

Published on

Private Sector & Development #27 - Vulnerabilities and crises: what role for companies?

Over two billion people throughout the world are currently living in countries in which development is being stymied by situations that are rife with conflict and violence. The growing number of both...

Publication

Published on

Private Sector & Development #1 - SME financing in sub-saharan Africa

The private sector is a powerful tool for the development of poor countries. It is both the main engine for growth and job creation and an intermediary for public policy, in particular thanks to publi...

Publication

Published on

Private Sector & Development #2 - How can the private sector help provide access to drinking water in developi...

We have decided to devote this second issue of Private Sector and Development – a bimonthly magazine that compares the opinions of Proparco’s community of investors with those of academic experts and...

Publication

Published on

Private Sector & Development #3 - What balance between financial sustainability and social issues in the micro...

The overarching virtue of microfinance is that in recent years it has managed to demonstrate that it is not only possible and necessary to implement services tailored to the poorest – it can also be p...

Publication

Published on

Private Sector & Development #4 - What are the economic and social impacts of the mobile phone sector in deve...

In most South countries, the mobile phone sector has developed – under the impetus and supervision of public regulatory authorities – via the private sector. A considerable number of developing countr...

Publication

Published on

Private Sector & Development #5 - Africa s financial markets a real development tool

This fifth issue of the magazine Private Sector and Development makes a comprehensive review of developments (recent and future) on Africa’s financial markets. It also highlights their utility and the...

Publication

Published on

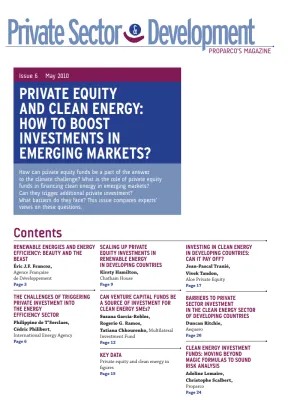

Private Sector & Development #6 - Private equity and clean energy: how to boost investments in emerging market...

It is imperative to develop a low-carbon economy in order to meet two major challenges that our societies will be facing over the next decade: how to guarantee an energy supply (under threat from the...

Publication

Published on