Share the page

Governance

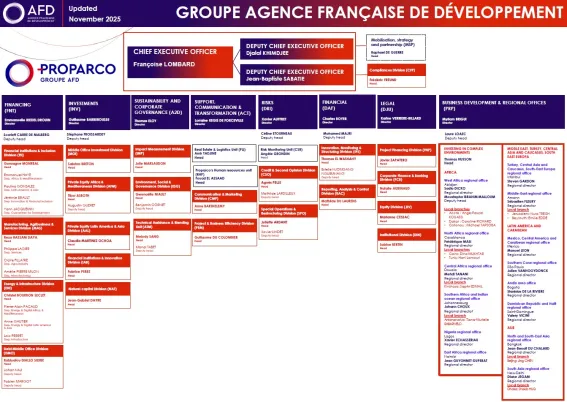

The governance of Proparco is based on structures that guarantee the transparency of its operation as well as its good management. Under the direction of Françoise Lombard, the General management prepares and proposes the company’s strategy, while supervising the fulfilment of the assigned objectives. The board of directors, chaired by Rémy Rioux, Chief Executive Officer of the Agence française de développement (AFD), determines Proparco’s main strategic orientations and ensures their implementation.

General management

The General management develops the company’s main orientations and supervises the operational implementation of the strategy determined by the Board of directors.

The General management includes the Chief Executive Officer, Françoise Lombard, and two Deputy Chief Executive Officers, Djalal Khimdjee and Jean-Baptiste Sabatié.

The General management is surrounded by an executive team that provides it with specialised technical support in each area of expertise.

The General management also relies on various internal committees in charge of studying opportunities for collaboration and partnerships that will promote the development of the private sector within Proparco’s sphere (in particular the Identification committee, the Project committee, the Commitment committee and the Disposals committee).

Proparco also has specialised internal committees that work with the general management and the executive teams with regard to identifying, measuring, managing and controlling risks, in order to ensure that the level of risks is suitable for its activities (in particular: the Internal counterparty risks committee, the Internal control committee, the Compliance committee and the Balance sheet management committee).

In its capacity as a financing company, Proparco has organised a risk management function that supervises the risks and reports to the General management.

Board of directors

The Board of directors, supported by specialized committees, determines Proparco's activities direction and oversees their implementation. It brings together experts and experienced professionals from a wide range of backgrounds.

As the guarantor of the transparency of its operation and good management, this diversity of participants provides Proparco with considerable expertise in strategic oversight and governance, while ensuring its true added value in its approach to financing projects.

It also provides opportunities for collaboration and partnerships that will serve to ensure its growth and expand its areas of expertise that contribute to its pro-development mission.

Three committees created by the Board of directors

The Investment advisory committee is called on for an opinion by the General management in order to assess the coherence of the financing and investing projects with Proparco’s strategic orientations, with the missions assigned to the AFD group, but also its financial conditions and main risks.

The task of the Appointments committee is to identify and recommend, to the Board of directors, candidates who could serve as directors. The Appointments committee ensures that the Board of directors is not dominated by a single person or small group of people under conditions that would harm the interests of Proparco.

The Risk and audit committee monitors the guidelines and rules imposed by French regulations and, in particular, the order of 3 November 2014 relative to the internal control of companies in the banking sector, payment services and investment services subject to oversight by the Prudential Control and Resolution Authority.

Company governance principles

Access to Proparco’s articles of association:

The articles of association define the company’s general operating rules, and are intended to provide third parties with information.

In particular, they describe Proparco’s corporate purpose (notably encouraging the development of the private sector and, in general, of the competitive productive sector in developing countries and French overseas territories, with the company’s aim being to provide financial assistance to companies in France and abroad, to carry out investments, and also to arrange technical support programmes that are specifically intended to strengthen the capacities of the financed companies or to finance projects focusing on innovation or that are intended to improve performances in environmental, social, governance and other areas).

The provisions for the operation of the Proparco Board of directors are clearly described in its rules of procedure. The Board of directors has also defined provisions for the operation of each of the committees that it has created, with each one having its own rules of procedure.

For purposes of good governance, the Board of directors has also adopted a charter for the members of the Board of directors and its committees, which reiterates the conditions under which the directors (and members of the specialised committees) perform their tasks: contribution to the efforts of the body in question, rights and means of the different bodies, rules regarding confidentiality, independence, ethics and integrity…

The professional ethics charter of the Agence française de développement group reiterates its mission, key values and shared ambition, as well as the major commitments regarding compliance, societal responsibility, and efforts to combat money laundering, corruption and fraud.

Capital and shareholding

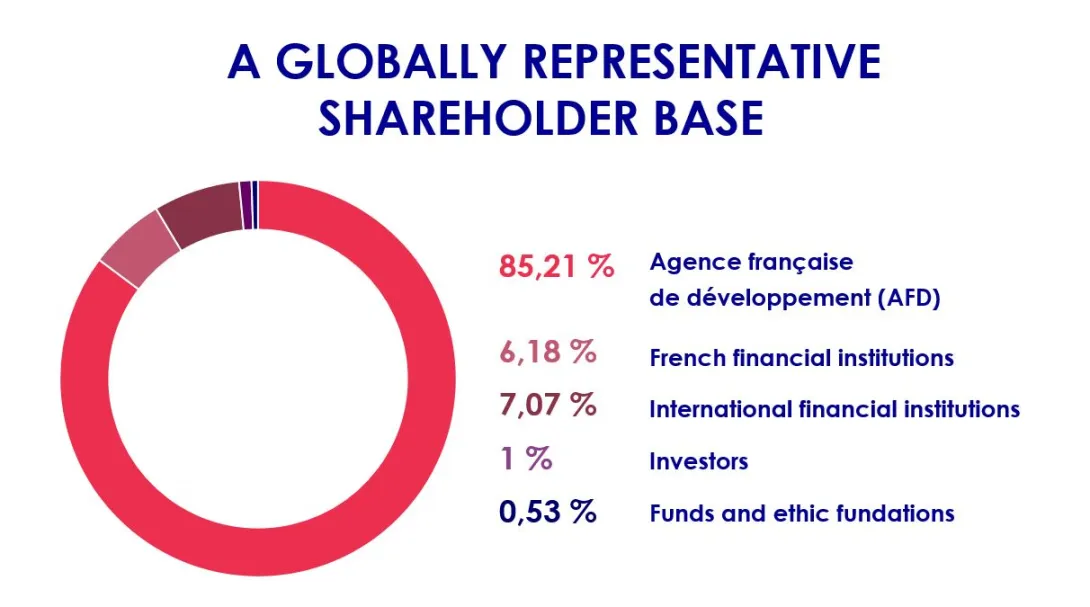

Proparco presently has around 20 shareholders.

In addition to its main subscriber, the Agence française de développement, the development of its activities is also supported by French, African and Latin American public and private financial institutions, service companies, industries active in its countries of intervention, as well as ethical funds and foundations.

The range of horizons of Proparco’s shareholders is one of its strengths: this community of investors from the North and South has a shared commitment in favour of sustainable development. Since their successive arrivals starting with the opening of the capital in 1990, they have played and continue to play a decisive role in the institution’s strategic oversight and good governance.

- 1977: creation of the Société de Promotion et de Participation pour la Coopération Economique (Proparco) by the Caisse Centrale de Coopération Economique (CCCE), which became AFD in 1998

- 1985: Proparco share capital increases to €9.14 million

- 1990: Proparco share capital increases to €34.3 million, status changed to a financial company approved by the French banking authorities (enabling Proparco to operate via equity, but also via loans and guarantees, as well as through consultancy and advisory services for the arrangement of deals), entry of public and private shareholders, financiers and industries from the North and South: Aga Khan Fund for Economic Development (AKFED), BNP Paribas, Coface, GDF Suez and Natixis.

- 1992: creation of the association of European Development Finance Institutions (EDFI), of which Proparco becomes a member

- 1993: Proparco share capital increases to €68 million

- 2001: Proparco share capital increases to €142.6 million

- 2004: creation of European Financing Partners (EFP) with nine other EDFIs and the European Investment Bank (EIB), a mutual fund dedicated to financing the private sector in African, Caribbean and Pacific (ACP) countries

- 2008: Proparco share capital increases to €420 million

- 2009: extension of Proparco’s geographical area of operations to all countries eligible for development assistance, creation of the Investment and Support Fund for Businesses in Africa (FISEA), held by AFD and advised by Proparco

- 2011: creation of the Interact Climate Change Facility with AFD, EIB and ten other EDFIs, a mutual fund dedicated to financing private sector operations in the South in renewable energies and energy efficiency in line with the AFD group “climate” strategy, started in the mid 2000’s

- 2014: Proparco share capital increases to €693 million

- 2020: Proparco share capital increases to €984 million

- 2023: Proparco share capital increases to €1 353 513 248