Share the page

Impacts for sustainable development

Through its funding, Proparco seeks to identify and support as many positive sustainable development impacts as possible.

Our approach

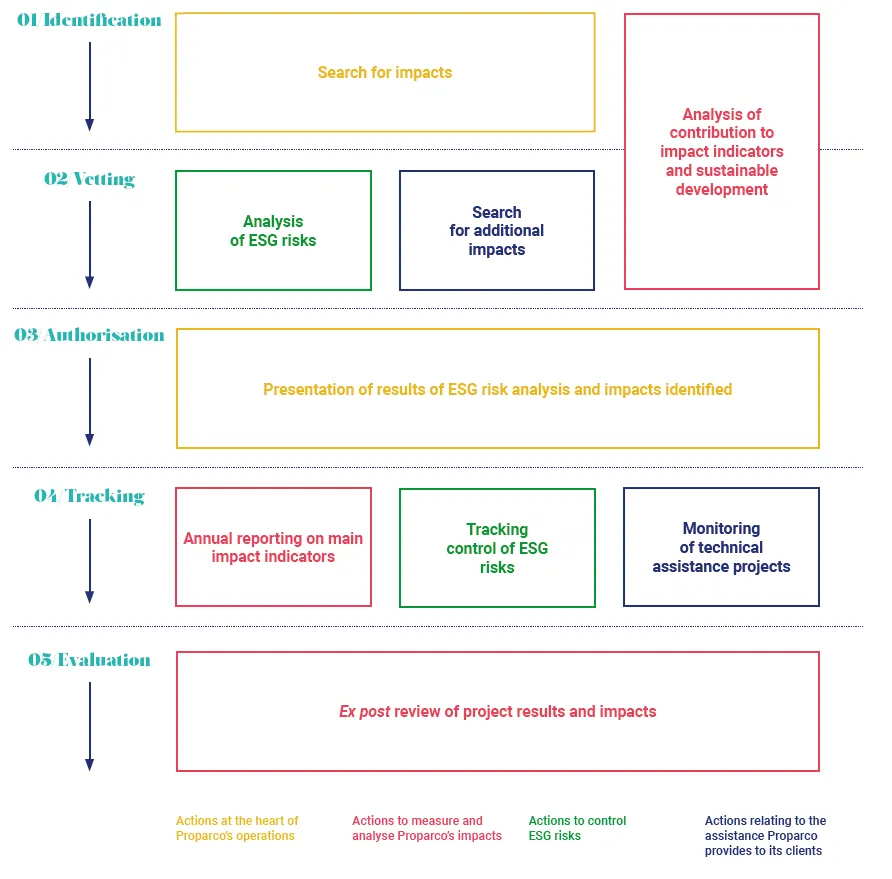

Because tracking and evaluating operations financed by Proparco is essential to the effectiveness of our action, monitoring and analysing impacts takes place throughout the project life cycle, from identification to ex post evaluation of its results.

Our approach is underpinned by cross-functional impact measurement that covers the analysis of environmental, social and governance risks inherent to each funding, as well as the support provided to our clients.

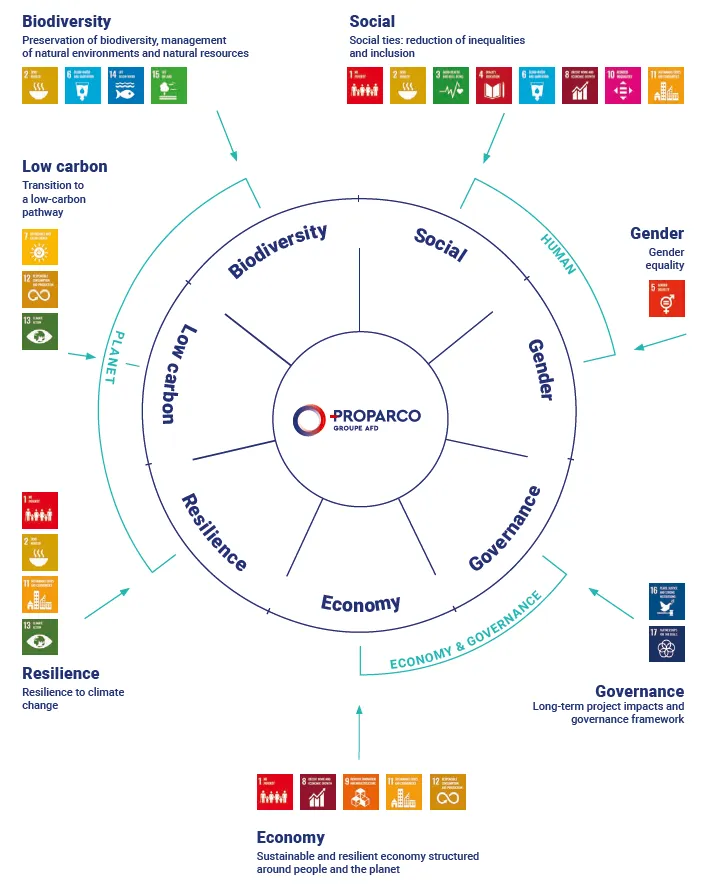

Proparco's impact thesis sets out, using a diagram, its logic of intervention in order to strengthen the contribution of private actors in achieving the Sustainable Development Goals (SDGs) and, in so doing, fulfil its mission: "Build the future by supporting private sector initiatives for a more just and sustainable world".

It details the linkages between the resources/inputs offered, the players who benefit from them and the activities supported, the outputs measured as part of Proparco's 2023-2027 strategy and the expected outcomes/impacts on development to which these outputs contribute, in line with the priorities defined in the strategy.

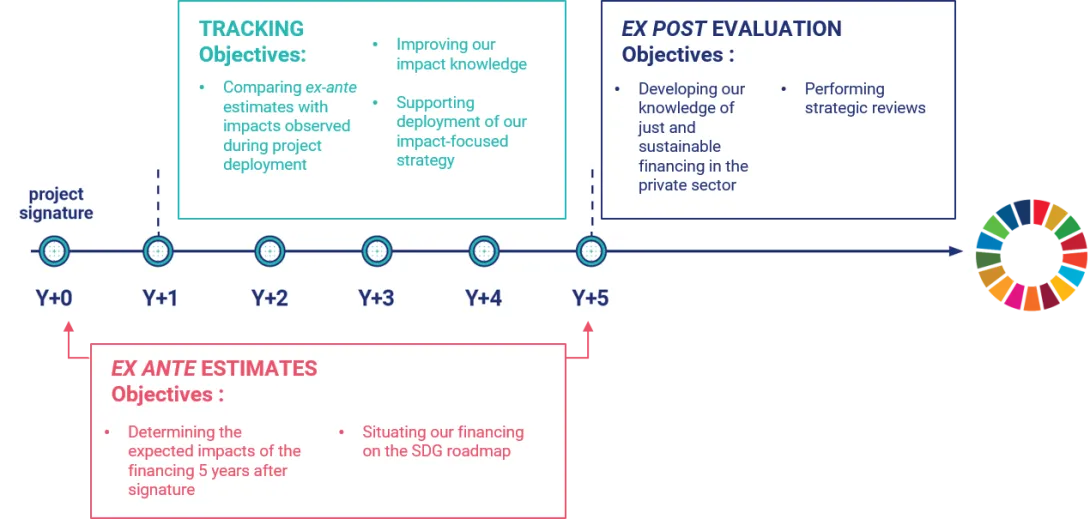

The results and impact measurement approach aims first to assess the funding decision by characterizing the expected impacts of the financing five years after its signature. This analysis is based on estimates made at the time of signature – also called ex ante impact estimates – for which attribution is not applied.

The Attributed development impact results represent the share of an investee's impact that is allocated proportionally to the size of the funding by Proparco. Proparco then collects the data needed to inform key indicators during annual impact monitoring campaigns. For this purpose, the development impact results are attributed to Proparco based on a proportional allocation method that considers Proparco’s share of an investee’s impact calculated using a PCAF based method. This method allows us to isolate the impacts of our contribution within a project and avoids potential multiple counts.

Ex-post evaluations of funding may also be carried out on a specific theme and/or sector. These exercises are performed for capitalization purposes, in order to know the real impact of financing, identify the most effective ways to support impact objectives and respond to the growing issues of accountability towards Proparco’s partners.

Project Information Documents detail only ex ante estimates, while the annual impact report also includes ex-post data.

The Impact Data platform enables Proparco to organize the impact data collection from its clients in a reliable and secure manner. You are a Proparco client and you need more information on the Impact Data platform? Contact impactdata@proparco.fr or download the user guide.

Our indicators

As a development finance institution, Proparco evaluates and reports on the impacts of its action by measuring the results and impacts of its financing. The anticipated impacts of each project are assessed based on impact indicators that contribute more generally to one or more of the Sustainable Development Goals (SDGs).

« Acting together for greater impact » :

Proparco's strategy 2023-2027

As part of its 2023-2027 strategy, Proparco has also defined monitoring indicators, including:

- Projects with climate co-benefits signed

- Projects that qualify for 2X Challenge

- Projects targeting the Bottom 40, i.e. the 40% of the population with the lowest incomes in a country (national data)

Our tools

Proparco uses various tools to measure the impact of its projects.

Proparco continued its work on the development of “sector impact sheets”, for internal use, to gain a better understanding of the potential impacts of projects. Each of these sheets identifies:

- the sector’s key economic, social and environmental challenges;

- the ‘impact thesis’ which analyses how the actions implemented can impact objectives;

- project types with high impact potential;

- and recommendations concerning “100% compliance with the Paris Agreement”, climate co-benefits and biodiversity qualification, and reduction of gender, socio-economic and territorial inequalities.

The sustainable development rating system is structured around three main pillars, based on Proparco's strategy for 2023-2027, and seven sustainable development dimensions. It provides a more detailed analysis of the type of impacts that projects can generate. It should also facilitate the analysis and monitoring of these impacts and nurture strategic thinking in terms of impact objectives.

The 2X Challenge is an initiative launched at the 2018 G7 in Canada, which aims to collectively commit and raise funds for projects that reduce gender inequality. 2X criteria have been devised to help participants identify compatible investments and initiatives.

To calculate the climate co-benefit of its projects, Proparco applies a methodology based on the Common Principles for Climate Finance Accounting, adopted by the multilateral development banks and IDFC members.

Consult the documents:

Partners

To meet the growing and increasingly complex demands of the private sector in the countries in which we do business, for several years now, Proparco have been expanding its partnerships with other development finance institutions (bi/multilateral and regional) and especially with European Development Finance Institutions (EDFIs), private investors and practitioners and experts.

In 2022, Proparco continued to contribute to the development of impact standards and best practices as a member of the Advisory Board of the Operating Principles for Impact Management and as a member of the Investors’ Council of the GIIN (Global Impact Investing Network) which provides a forum for experienced impact investors to strengthen the practices of impact finance market players. Proparco also contributed to the “Impact Finance” Task force of the “Institut de la Finance Durable” – formerly Finance for Tomorrow – by participating in the “Charter for impact funds” and “Hub Resources” working groups.

On 2019, Proparco signed the Operating Principles for Impact Management - a set of 9 principles which provide a framework for impact investing.

These Impact Principles, whose formulation was led by the International Finance Corporation (IFC), aim to provide a common standard for what constitutes impact investing and instil greater transparency and discipline in the management of impact investments. The Impact Principles are intended to be a reference point for investors for the design and implementation of their impact management systems, ensuring that impact considerations are purposefully integrated throughout the investment lifecycle. In June 2023, Proparco is one of the 176 signatories to the Operating Principles for Impact Management.

As a signatory to the Impact Principles, Proparco is required to publish an annual Disclosure Statement describing how its impact management system is aligned with each of the 9 Principles, and to provide a regular independent verification report of this alignment (documents available below).

In June 2021, Proparco was elected member of the Advisory Board of the Operating Principles for Impact Management for 2021-2023, along with 10 other Signatories. The Advisory Board provides the Impact Principles Secretariat with advice on the implementation and evolution of the Impact Principles.