Search results

Ecobank Tchad rejoint le programme Trade finance de Proparco, initié depuis 2018 avec le Groupe Ecobank

Proparco and Ecobank Group are reaffirming their commitment to supporting the supply of essential products in Africa. They are reinforcing their historic partnership through the integration of the Cha...

News

Published on

Proparco and Vitas Lebanon strengthen their commitment to financial inclusion for MSMEs in Lebanon

Proparco and Vitas Lebanon sign a Memorandum of Understanding (MoU) for a third portfolio guarantee. This risk-sharing mechanism will enable Vitas Lebanon to cover part of its loan portfolio in suppor...

News

Published on

Voices for Change - Rachael Antwi, Ecobank

In this Voices for Change episode, Rachael Antwi, Group Head of Sustainability at Ecobank, shares how one of Africa’s largest banks is turning sustainability into action — financing green innovation,...

Publication

Published on

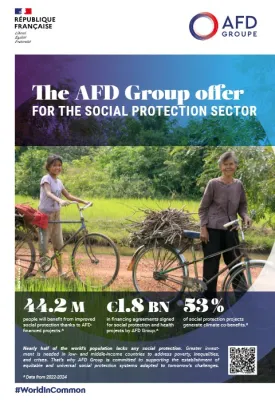

AFD Group offer - Social protection

Nearly half of the world’s population lacks any social protection. Greater investment is needed in low- and middle-income countries to address poverty, inequalities, and crises. That’s why AFD Group i...

Publication

Published on

AFD Group offer - Health

More than half of the world’s population lack access to essential health services, and health inequalities among world regions remain very high. AFD Group supports the establishment of health and soci...

Publication

Published on

Senegal: Proparco supports Gade Gui in launching its egg production operations

In Dakar, Proparco has granted a long-term structured loan to Gade Gui , one of the leading companies in the poultry industry and a key player in Senegal’s food security. This marks Proparco’s first d...

News

Published on

Ventures Platform Secures $64M First Close for Pan-African Fund II to Power Africa’s Next Tech Wave

Ventures Platform, Africa’s leading seed-stage fund, has announced the $64 million first close of its second fund, VP Pan-African fund II, aimed at deepening seed investments, catalysing Series A roun...

News

Published on

Fondation Albaraka

The Moroccan microfinance institution Albaraka Foundation is seeking to develop its loan portfolio. PROPARCO is helping it review its anti-money laundering and terrorist financing procedures.

Project

Launch of the Impact+ facility: Proparco and the EU mobilize €1.1 billion in guarantees for African SMEs

At the Africa Financial Summit (AFIS) in Casablanca, Proparco and the European Union announced the launch of the Impact+ Facility — an innovative guarantee program designed to unlock the potential of...

News

Published on

Proparco partners with AXA IM Alts to invest in nature and accelerate climate action

Proparco has joined IFC and DEG in supporting AXA IM Alts’ Natural Capital & Impact strategy, which finances projects aimed at tackling deforestation, restoring ecosystems, and preserving biodiversity...

News

Published on

Proparco invests in Kenya’s 100 MW Kipeto Wind Farm, alongside Meridiam

Proparco partners with Meridiam to support Kenya’s renewable energy capacity by investing in Kenya's second-largest wind farm, supplying clean power to hundreds of thousands of households.

News

Published on

Voices for Change - Tamer El-Raghy, ARAF

In this Voices for Change episode, Tamer El-Raghy, managing director of the Acumen Resilient Agriculture Fund (ARAF), shares why climate finance for smallholder farmers is vital for Africa’s future.

Publication

Published on

Proparco partners with Ardian to invest in nature and accelerate climate action

Alongside the European Investment Bank (EIB) and British International Investment (BII), Proparco is participating – as a lead investor – in the first €100 million funding round of the Nature-Based So...

News

Published on

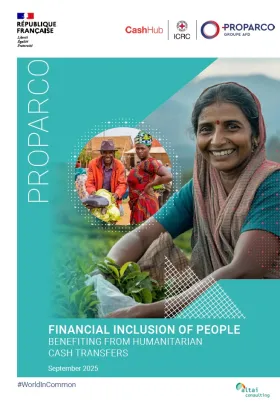

Cash Hub, ICRC, Proparco - Financial inclusion of people benefiting from humanitarian cash transfers

In the face of multiplying humanitarian crises, cash transfers now account for nearly 20% of global aid, compared to just 6% a decade ago. This "cash revolution" has profoundly transformed the way aid...

Publication

Published on

DenizLeasing and Proparco sign €50M green finance loan

DenizLeasing has signed a 50 Million EUR loan agreement with Proparco. The financing will be used to support renewable energy investments in Turkey as well as projects that reduce carbon emissions.

News

Published on

Voices for Change - Michelle Espinach, Banco Promerica

In this Voices for Change episode, Michelle Espinach, Sustainable Bank Manager at Banco Promerica Costa Rica, shares how Grupo Promerica is turning climate commitment into concrete action.

Publication

Published on

Voices for Change - Rob Kaplan, Circulate Capital

In this Voices for Change episode, Rob Kaplan, Founder of Circulate Capital, reflects on how plastic pollution is damaging coastlines, livelihoods, and economies — costing the Asia-Pacific region near...

Publication

Published on

Voices for Change - Anibal Wadih, GEF Capital

In this Voices for Change episode, Anibal Wadih, Founder of GEF Capital, explains why GEF Capital was built on a simple premise: capital should solve real climate problems — and doing so must be profi...

Publication

Published on

FONDS GEF

The Africa Sustainable Forestry Fund, managed by GEF, invests in African plantations and forests. The fund aims to contribute to sustainable forest management in Africa based on FSC certification.

Project

IDB Invest Sign New Agreements to Increase Private Investment in Latin America and the Caribbean

IDB Invest signed three Memorandum of Understanding (MOUs) with Germany’s development finance institution DEG - Deutsche Investitions- und Entwicklungsgesellschaft, the Dutch Entrepreneurial Developme...

News

Published on