Search results

Voices for Change - Andrew Vo, SeABank

In this Voices for Change episode, Andrew Vo, Head of Foreign Investments at SeABank, outlines the real impacts of climate change across Vietnam, from droughts and devastating storms to the threat fac...

Publication

Published on

Voices for Change - Thierry Hebraud, Mauritius Commercial Bank

In this Voices for Change episode, Thierry Hebraud, CEO of Mauritius Commercial Bank, reflects on the real dilemmas behind global energy transition policies.

Publication

Published on

Voices for Change - Burak Koçak, DenizLeasing

In this Voices for Change episode, Burak Koçak, CEO of DenizLeasing, reflects on how Turkey’s first climate law set a clear direction: economic growth and sustainability must advance together.

Publication

Published on

Proparco joins Axian Telecom’s new bond issuance to boost digital access in Africa

Proparco is pleased to announce its participation in the new public bond issuance of Axian Telecom Holding for an amount of USD 25 million. The success of Axian Telecom’s new USD 600 million bond issu...

News

Published on

2025 Disclosure Statement Operating Principles for Impact Management

The Impact Principles (Invest for Impact | Operating Principles for Impact Management) set inspiring goals to reach for all responsible finance investors eager to promote business in common. They prov...

Publication

Published on

FEFISOL 2015

The European Solidarity Financing Fund for Africa supports microfinance, fair trade and organic farming in local currency, while providing technical assistance to beneficiary organizations.

Project

ILX and Proparco partner to support development in emerging markets through a B-Loan

By joining this transaction alongside Proparco, ILX supports the mobilisation of private finance and contributes to risk-sharing efforts that allows to mobilise additional investors. The partnership u...

News

Published on

Supporting Ukraine: Proparco's enhanced strategic response

Proparco has reiterated its commitment to rebuilding Ukraine's economy at the Ukraine Recovery Conference, organised on 10 - 11 July 2025 in Rome. Its strategy is based around four key focuses aimed a...

News

Published on

Boosting job creation in Africa’s sports sector

In a significant move to accelerate job creation and enhance the competitive sports and entertainment sector in Africa, IFC, a member of the World Bank Group, and Proparco, a subsidiary of the Agence...

News

Published on

Sustainable plantations: Proparco supports ECOM towards biochar coproduction

Biochar, charcoal derived from organic residue, is the product of an ancient practice that has been reinvented to optimise carbon storage and restore agricultural soils. With Proparco's support, EC...

News

Published on

How gender lens investing is shaping more inclusive workplaces

To understand the outcomes of its gender-related investments to date, Proparco commissioned an evaluation of its portfolio. The goal was to assess the contributions of these investments to gender equa...

News

Published on

FEH

Proparco is guaranteeing the financing allocated by the Asian Development Bank to Far East Horizon, so that it can continue to support more environmentally friendly and cleaner means of transport – pa...

Project

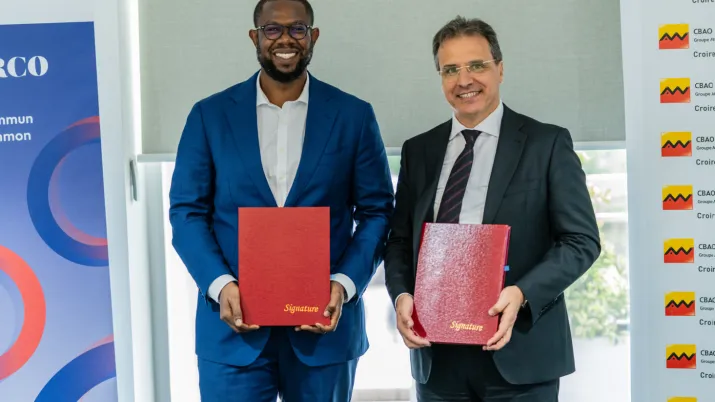

CBAO strengthens credit access for Senegalese MSMEs

Proparco and CBAO, the Senegalese subsidiary of the Attijariwafa bank group, have formalized their partnership by signing their first ARIZ guarantee, designed to facilitate access to credit for micro,...

News

Published on

Case studies from Proparco ex post gender evaluation

The series of four case studies presented in this document illustrate clients’ gender journeys. These examples demonstrate the impacts of Proparco's gender strategy and provide insights into the effec...

Publication

Published on

Proparco commits to SME financing in Senegal

Proparco has granted a €3 million ARIZ portfolio guarantee to FBNBank Senegal, a subsidiary of First Bank of Nigeria Plc, to cover a €6 million loan portfolio. This operation aims to support the bank’...

News

Published on

Independent Complaints Mechanism (ICM) policy revision: formal public consultation on the Draft ICM Policy com...

The Independent Complaints Mechanism (ICM) depends on a robust and appropriately framed policy to inform and guide its activities, and the Development Finance Institutions (DFIs) have committed to reg...

News

Published on

Proparco supports SME financing alongside BCI Guinea

The Banque pour le Commerce et l’Industrie Guinée (BCI Guinea), a subsidiary of the BCI Mauritania group, and Proparco, the private sector arm of the AFD Group, signed on Monday, September 8, 2025, a...

News

Published on

Proparco invests in Accion Venture Lab Fund II to support financial inclusion in Africa, Asia, and Latin Ameri...

Proparco is renewing its partnership with Accion by investing in its latest venture capital fund dedicated to supporting start-ups working to promote financial inclusion in countries in Asia, Latin Am...

News

Published on