Search results

Equity Bank Holding : USD 100m loan from Proparco to support SMEs in Kenya

Equity Bank Holding is committed to small and medium-sized enterprises in several countries in East Africa. Proparco has allocated to Equity Bank to support SMEs in Kenya. This project is part of the...

Publication

Published on

Climat - activity report 2019

Since 2015, tackling climate change has been a core aspect of the AFD Group identity. This positioning has been strengthened by the adoption of a 2017-2022 climate strategy that reflects the Group’s a...

Publication

Published on

Presentation of Choose Africa Resilience guarantee

In response to the economic crisis triggered by Covid-19, which is hitting microenterprises and SMEs hard, AFD Group is extending its mechanism with Choose Africa Resilience. This EUR 1bn program is d...

Publication

Published on

Presentation of Choose Africa Resilience

How the Resilience component of Choose Africa is deployed to companies in Africa weakened by the crisis related to Covid-19? Discover in video the AFD Group's solutions through two examples of clients...

Publication

Published on

Teaser : presentation of Choose Africa Resilience

Teaser : Watch our video on AFD Group’s solutions with two examples of entrepreneurs in Africa.

Publication

Published on

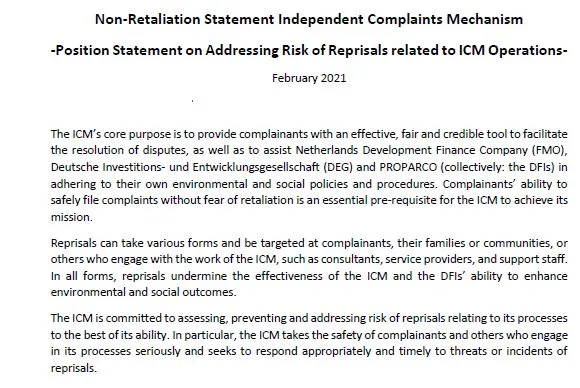

Non-Retaliation Statement Independent Complaints Mechanism - Position Statement on Addressing Risk of Reprisal...

The ICM’s core purpose is to provide complainants with an effective, fair and credible tool to facilitate the resolution of disputes, as well as to assist Netherlands Development Finance Company (FMO)...

Publication

Published on

Financial institutions as key contributors to climate action

This brochure aims to sensitize financial institutions to their role in the fight against climate change. For example, they have a key role to play in mobilizing private climate finance. This brochure...

Publication

Published on

Private Sector & Development #35 - Preserving biodiversity: the private sector in action

To mark the COP 15 of 2021, the 35th edition of Private Sector & Development imagines the role of the private sector in financing biodiversity and proposes steps to better involve businesses in the re...

Publication

Published on

Meeting with Société Générale Burkina Faso, Choose Africa partner

Interview with Robert Aimé Diallo, Director of Corporate Clients at Société Générale Burkina Faso, and Stéphane Sawadogo, Head of the Professional Clients Market. Discover how the bank supports the gr...

Publication

Published on

Investing and supporting SMEs in Africa - 10 years of impact for FISEA

The main objectives of the evaluation were to assess the economic, social and environmental impacts of FISEA. This involved estimating the value added by the technical assistance facility and offering...

Publication

Published on

Choose Africa. In Zambia, Dorothy Kacompe, a farmer's journey in action

Discover the story of Dorothy Kasompe in Zambia who developed Funamwango Farm, a citrus farm located on the outskirts of Lusaka. A woman entrepreneur beneficiary from Choose Africa.

Publication

Published on

Choose Africa. In Zambia, Kenneth Kapampa, a pharmacist's journey in action

Discover Kenneth Kapampa’s story in Zambia, a pharmacist and founder of the pharmaceutical distribution company Ashton Pharmaceuticals. An entrepreneur, beneficiary from Choose Africa.

Publication

Published on

Choose Africa. In Côte d'Ivoire, Cissé Abdoul Aziz, the journey of the founder of Afribacom

This is the story of Cissé Abdoul Aziz, a scientist who discovered his entrepreneurial spirit. He tells the story of the creation of his company, Afribacom, which employs 30 permanent staff, and why h...

Publication

Published on

Key figures 2020

Proparco is the private sector financing arm of Agence Française de Développement Group (AFD Group). It has been promoting sustainable economic, social and environmental development for over 40 years....

Publication

Published on

PRESS KIT «CHOOSE AFRICA ON AIR» 8 JUNE 2021 11AM PARIS TIME, 9AM GMT

Weakened by Covid-19 crisis, SMEs will play a key role in the recovery. It is in this context that PROPARCO will review the first years of the initiative during the digital broadcast “Choose Africa On...

Publication

Published on

AB BANK ZAMBIA, a partner of Choose Africa in Zambia

Created in 2011, AB Bank Zambia is the only SME and micro-entrepreneur financing bank in Zambia. ABZ has 7 branches and employs 450 staff. In 2019, the FISEA facility, managed by Proparco, invested €1...

Publication

Published on

Poa! internet, a key-player of the digital transformation in Kenya

Based in Nairobi, poa! internet is an innovative enterprise, providing fast, affordable, unlimited Internet to low-income population. Poa! internet received an investment of US$6.1 million from the No...

Publication

Published on

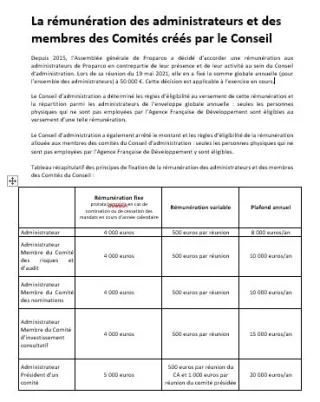

Compensation of the directors and of the members of the committees created by the Board

Since 2015, Proparco's General Assembly has decided to grant compensation to Proparco's Directors for their presence and activity within the Board of Directors. At its meeting of May 19, 2021, it set...

Publication

Published on

Sustainable Development Report 2020

Proparco is publishing its third sustainability report, with figures to the end of 2020. This report presents the main results and actions we have taken to achieve the Sustainable Development Goals. T...

Publication

Published on

Choose Africa. In Senegal, Adama Sène Cissé, the journey of the cofounder of GADE-GUI

This is the story of Adama Sène Cissé, a banker who discovered his entrepreneurial spirit. She tells the story of the creation of her company, Gade-Gui, specialized in groundnut processing. Gade-Gui e...

Publication

Published on