Share the page

CBAO, the Senegalese subsidiary of the Attijariwafa bank group, strengthens credit access for Senegalese MSMEs with support from Proparco

Published on

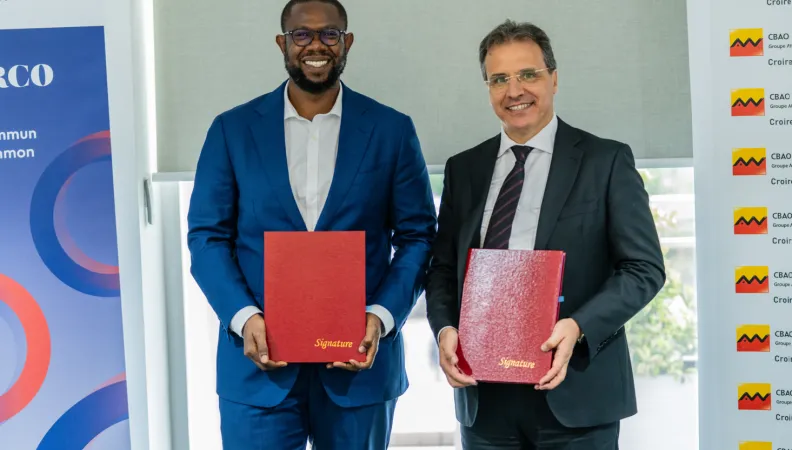

Proparco and CBAO, the Senegalese subsidiary of the Attijariwafa bank group, have formalized their partnership by signing their first ARIZ guarantee, designed to facilitate access to credit for micro, small, and medium-sized enterprises (MSMEs) in Senegal.

This operation reflects Proparco's commitment to strengthening its partnerships within the WAEMU region by working alongside the Attijariwafa bank group to expand its impact and build a long-term relationship.

By granting CBAO an ARIZ guarantee worth XOF 5 billion (EUR 7.5 million), Proparco will cover 50% of a loan portfolio to Senegalese MSMEs. The operation supports CBAO’s proactive strategy to provide financial assistance to this vital customer segment.

In Senegal, MSMEs account for nearly 90% of business entities, contribute 30% to GDP and, most importantly, account for 60% of the active workforce, many operating within the informal sector. Yet, their access to credit remains limited, hindering their growth and employment potential.

Implemented by Proparco and supported by the AFD Group, the ARIZ mechanism incentivizes partner financial institutions to expand their credit offerings to MSMEs, which are the cornerstone of more inclusive and sustainable growth. By covering up to 50% of potential losses on a loan portfolio, this guarantee reduces banks’ risk, encouraging them to provide appropriate financing.

This operation is part of the French Choose Africa initiative, which demonstrates France’s concrete commitment to actively supporting African entrepreneurship and fostering a dynamic private sector across the continent.

The ARIZ guarantee will also directly contribute to Proparco’s Strategic Objective No. 1: “Investing in a sustainable and resilient economy,” and to Sustainable Development Goal (SDG) No. 8: “Decent work and economic growth,” by helping to maintain thousands of jobs in Senegal.