Share the page

Sonata: Equity investment to support the development of microfinance in India

Project

-

Signature date

-

-

Location

-

India

-

Financing tool

-

Financing amount (Euro)

-

8266630

-

Financing details

-

Equity investment of INR 423,658,772 in 2016 and INR 199,999,868 in 2018

-

Customer

-

SONATA FINANCE PRIVATE LIMITED

-

Type of customer

-

Microfinance

-

Country of headquarters

-

India

-

Project number

-

PIN1045

-

Environmental and social ranking

-

IF-C

This information is given at the time of signature, without prejudice to any developments in the operation/project.

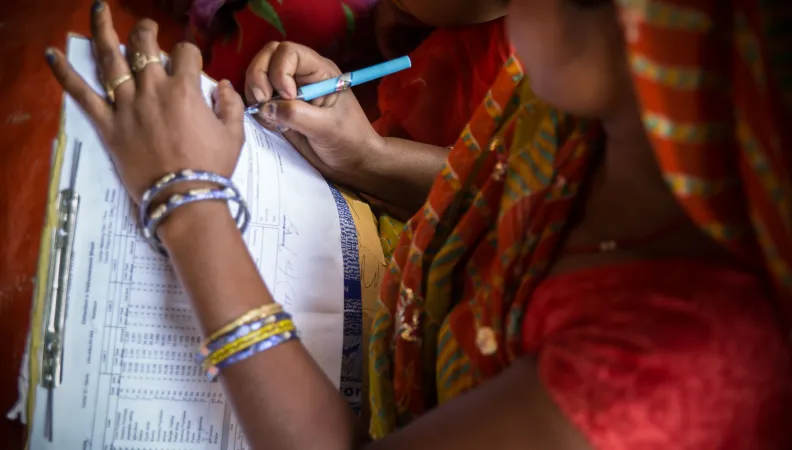

Sonata is an Indian microfinance institution specialized in solidarity loans. Its 740,000 clients are all women.

Proparco made its first equity investment in SONATA in 2016 and subsequently made an additional investment of EUR 2.5m in 2018, in the form of mandatory convertible preference shares, in order to strengthen the institution’s equity.

Client presentation

SONATA is a microfinance institution (MFI) based in Uttar Pradesh, the most populous State in India and where there are also some of the poorest people in the country. SONATA was set up in 2006 by Mr. Anup Kumar Singh (CEO), who has almost 20 years' experience in the microfinance sector. It is today firmly established in rural and semi-urban areas in 8 States in North-East India, where there is a low level of financial inclusion. The MFI is specialized in solidarity loans to women and benefits from an excellent knowledge of its market segment, with a strong capacity to innovate in order to fulfill its social mission. As of March 2018 (month for the closing of accounts in India), SONATA was serving some 700,000 clients via a network of 425 branches, with a loan portfolio of EUR 165m.

Project description

Proparco’s equity stake stands at 12.1% of SONATA’s capital.

This project is part of the 2X Challenge initiative. This multi-stakeholder initiative aims to support projects that empower women as entrepreneurs, business leaders, employees and consumers of products and services, and increase their participation in the economy.

This initiative thus contributes to Sustainable Development Goal #5 (Gender Equality).

Project impact

The SONATA project will mainly contribute to improving access to credit for disadvantaged populations in India, where the rate of access to banking services is only 53%. As a shareholder, Proparco is contributing to strengthening the economic and financial sustainability of the MFI. This will allow the institution to pursue its objective of offering microloans to economically vulnerable Indian women living in rural areas. 80% of the institution’s clients currently live on less than USD 1.25 a day, 75% live in rural areas and the average loan amount is relatively low, as it stands at approximately EUR 236.